Discover Soldo

Learn more about the Soldo product and how its capabilities can work for you.

Welcome to Soldo

With our API documentation, you can easily integrate Soldo's capabilities into your applications and workflows.

Whether you're a developer looking to utilise the power of the Soldo platform, or a business professional wanting to improve your financial control, you've come to the right place. In this documentation, you'll find detailed information, resources and examples to help you make the most of Soldo's API.

Ready to explore all Soldo has to offer? Let's go!

Here you'll find:

- An introduction to Soldo

- A breakdown of all the Soldo functionalities

- What to do next

![]()

![]() To change the colour scheme, click the icon in the top right-hand corner.

To change the colour scheme, click the icon in the top right-hand corner.

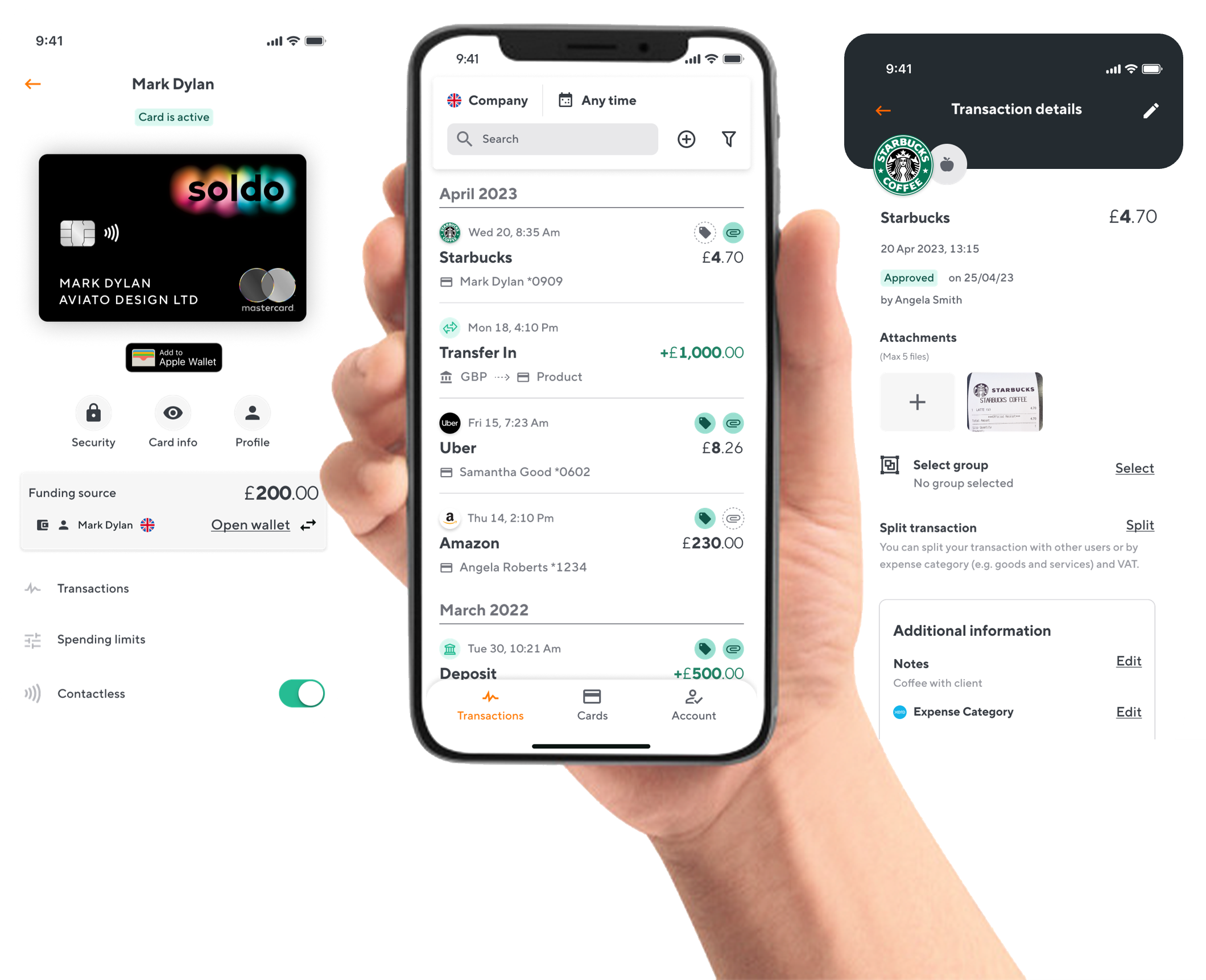

What is Soldo?

Soldo is a leading financial platform designed to simplify business expenses. By combining secure company cards with a powerful business spend management platform, Soldo streamlines how companies manage budgets, spending, and reconciliation.

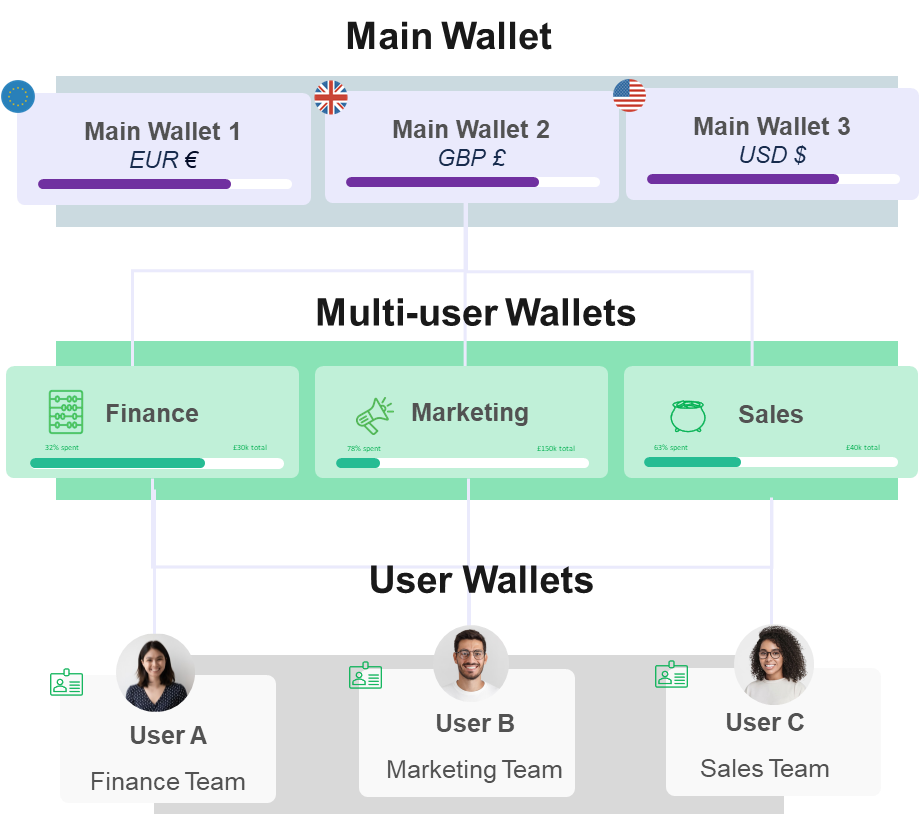

Organise company spending into wallets

Main wallet

The main wallet holds company money transferred from your business bank account. It's set to one currency, either GBP £, EUR € or USD $.

Company (multi-user) wallets

Company wallets allow you to allocate a ring-fenced pot of money to specific teams or cost centres. Other cards, like user cards, can then be linked to draw money from the wallet.

User wallets

User wallets allocate money to an employee, used to top up their card. Money can be transferred from the main wallet or a company wallet, and automatic top-ups can be set up.

You can view the endpoints to manage your wallets here.

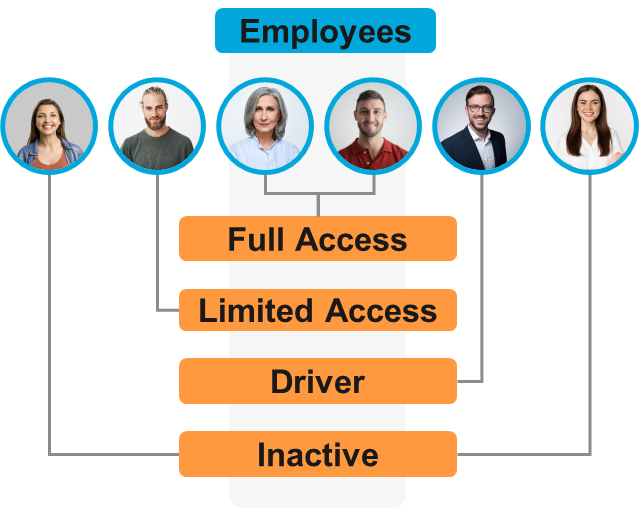

Map your organisational structure

You can create roles and set default permission with User profiles

Admin/Super Admin

- Admins and Super Admins have access to all Soldo features, and can manage the company wallets, users, and cards.

- Super Admins can assign the Admin role, and are subject to KYC checks.

- Admins and Super Admins can set permissions for all users within the company, delegating sign-off to managers, and optimising the day-to-day flow of spend within Soldo.

Manager/Leader/Supervisor

- These roles see only relevant transactions for employees within a defined group e.g. those in their reporting line.

- Mangers help Admins ensure teams are spending within their company's expense policy.

- These roles are not able to create new wallets, users or cards, or create reports for the company.

Employee

- Employees can see their cards and manage their personal expenses.

- They'll see a restricted view of the platform and mobile app, but still be able to request money, view their spending and add details to transactions.

- Employees aren't able to create users, order cards or manage company money.

You can also define the level of access granted to users with the 'Employee' role, allowing you to limit access to cards and restrict spending in certain categories.

You can view the endpoints to manage your users here.

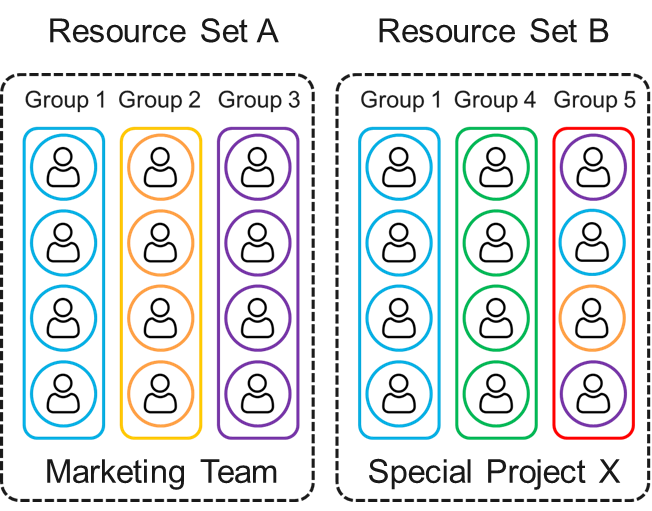

Collect company resources into groups

Collect users, company wallets or cards into a single resource set, where controls can be applied and reports generated.

- Create groups and associated wallets, then allocate funds to replicate your team budgets.

- Each group can have a leader. A group leader is in charge of workflows, and can be assigned to multiple groups at once if required.

- A group can have one or more wallets, which may be connected to one or more cards (plastic and virtual cards only).

You can view the endpoints to manage your groups here.

Create cards for your employees

- Assign every employee their own physical or virtual payment card.

- Give teams, projects or cost centres physical or virtual cards.

- Approve spend on work-related expenses in a controlled way, with immediate visibility.

- A virtual Soldo Mastercard® that can be requested by your users and used for up to 7 days or 10 transactions.

- Great for ad hoc, online, one-off spending.

- Work-related purchases made by employees using their own money can be added to Soldo.

- These can be easily tracked, reviewed and approved on the web or mobile app.

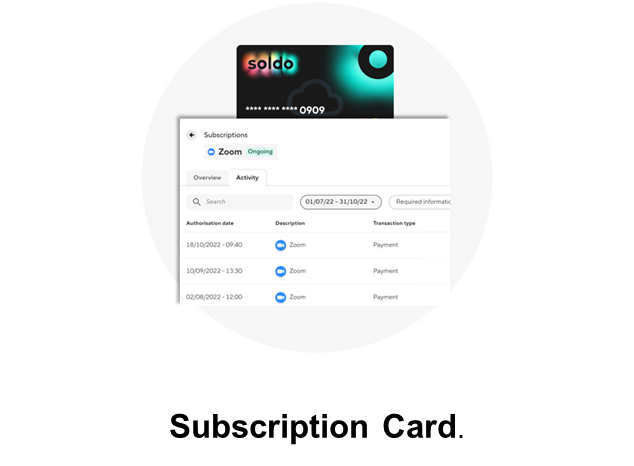

- Virtual cards for each subscription supplier for recurring subscriptions, assignable to multiple team members.

- See every subscription payment in one dashboard, including total expenditure and card balance, to avoid service outages.

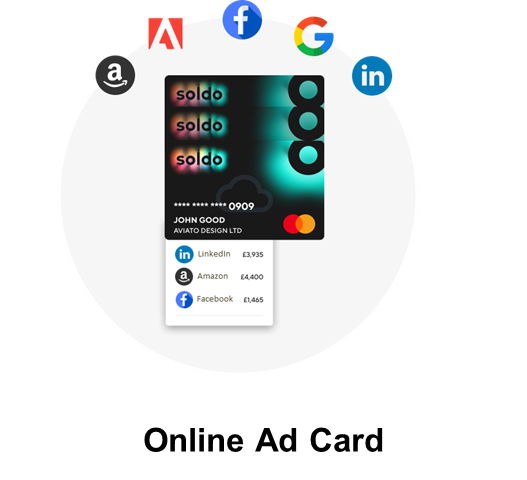

- Virtual cards that can be created and used for each online ad campaign, assignable to multiple team members.

- Easily spot duplicate online ad spend with automated, low-balance reminders.

You can view the endpoints to manage your cards here.

Categorise and track every transaction

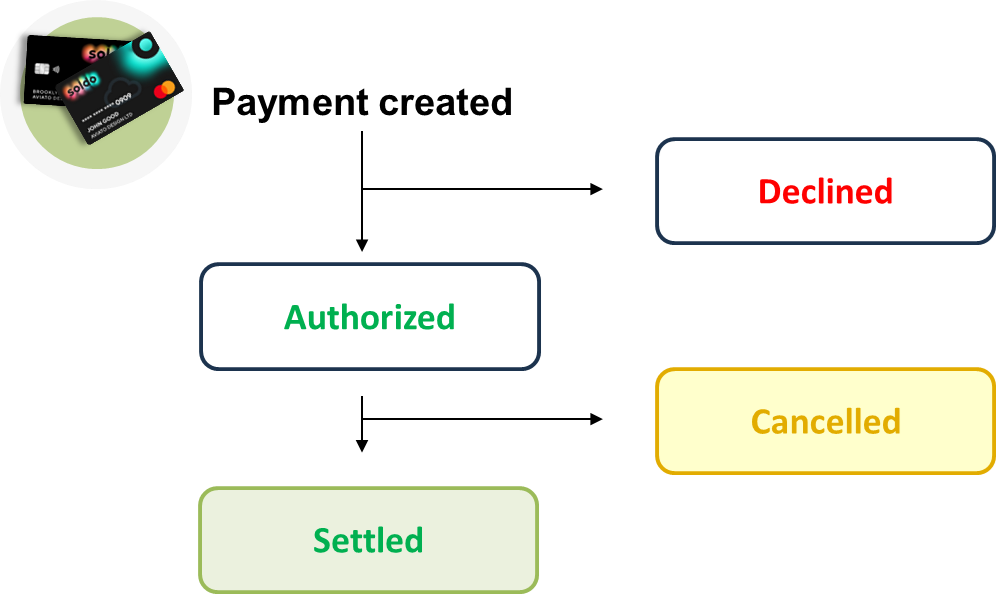

Once a payment is made with a Soldo card, the transaction lifecycle will follow one of the following possible flows:

Declined: When a payment is declined, it means that Soldo has been unable to process the transaction. This can happen for various reasons, such as insufficient funds, an expired card, incorrect payment information, or suspicions of fraudulent activity. The payment has not been completed, and the intended transaction is not authorised.

Authorised: An authorised payment status indicates that Soldo has approved the transaction and reserved the necessary funds. However, the actual transfer of funds may not have occurred yet. This status typically precedes the settlement, where the funds are transferred from the customer's account to the recipient's account.

Cancelled: When a payment is cancelled, it means that the transaction was initiated but later voided or terminated before completion. This can happen for various reasons, such as customer requests, merchant errors, or changes in the payment's terms or conditions. In a cancelled payment, the funds are usually released back to your account.

Settled: Settled status means that the payment has been completed, and the funds have been transferred from the payer's account to the payee's account. This is the final stage of the payment process, and the transaction is considered closed. In the context of merchant transactions, settled payments indicate that the funds are now available to the recipient for use or withdrawal.

With Soldo, there are several ways to classify expenses:

Expense categories classify employee expenses according to the company expense categories and VAT rates associate them automatically with the expense categories.

Lists can be used to categorise things like specific projects, teams or expenses - anything that makes it easier for you to manage your business expenses.

Autotags allow you to automate selections from a list, saving you and your employees time in assigning things like categories, departments and projects.

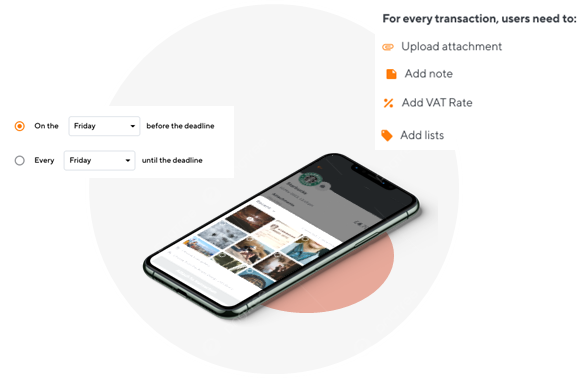

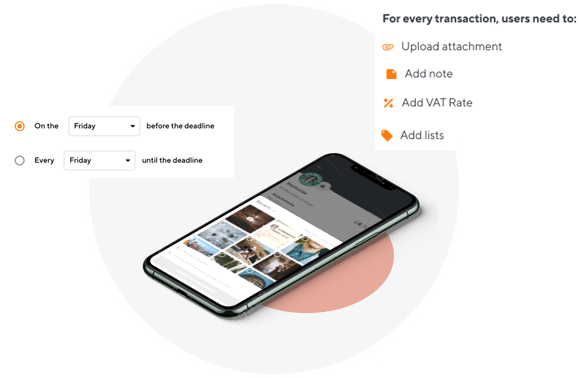

With the Reminders feature, you can set automatic email reminders for employees to encourage them to add the necessary details to their expenses. You can also make certain fields, like attachments and notes, mandatory in the transaction details, so employees are always required to fill them in.

You can view the endpoints to manage your transactions here.

Improve your expense review process

The Expense review feature allows finance teams to review, track, and approve all business expenses made using a Soldo card.

With Soldo, you can easily manage the expense review process from start to finish:

- Create an expense policy for employees to follow to help control company spending.

- Build approval workflows that match your company's structure for a quick and efficient process.

- Easily delegate the approval of employee expenses to managers.

- Approve all expenses within Soldo, so expense reports get done right away.

- Send reminders to employees if any mandatory transaction details are missing.

- Provide all employees with an overview of their approval journey, so everyone knows what’s going on.

You can view the endpoints to manage the Expense review feature here.

Updated 2 months ago

Now you're familiar with the Soldo product, check out our Quickstart guide to get up and running with the Soldo Business API.